There’s still hope for the industry, even if Congress doesn’t pass marijuana reform.

Earlier this year, there was excitement that the federal government might reschedule marijuana from a Schedule I substance down to Schedule III. It would be a big step toward decriminalization, which could help open up doors for the industry. But as with everything related to the government, it can take time. Seasoned cannabis investors know by now not to get their hopes up on reform.

But there’s one way the industry may get a boost even if reform doesn’t happen. And that’s via Elon Musk. The billionaire has significant resources at his disposal, including a popular social media platform in X, formerly known as Twitter. And his plans for developing X into something much bigger should have cannabis investors optimistic about the future.

The cannabis industry needs help

A big problem for the cannabis industry today is that it faces multiple headwinds. It’s difficult to market and advertise the products. Due to the federal ban on pot, it also can’t be shipped cross state lines. That means a company effectively has to grow products in every state that it wants to sell in, which is by no means efficient.

Plus, many cannabis companies struggle to open and maintain bank accounts. The big banks are worried about repercussions from the federal government and avoid doing business with the marijuana industry. As a result, many cannabis businesses end up holding excessive amounts of cash on their premises, making them vulnerable targets for criminals.

Why Elon Musk could be the one to save the day

Musk has both the wealth and the power which may be necessary to drastically improve conditions for the cannabis industry. His social media platform, X, doesn’t prohibit cannabis advertisements the way that Facebook’s Meta Platforms does. It gives companies and consumers a way to discuss cannabis freely, which can make it a valuable platform for the industry.

This is something that investors should keep an eye on because a social media platform is just the start. Musk’s goal for X seems to be to transform it into an “everything app” the way WeChat is in China. Processing financial transactions is a key part of that strategy, and it seems inevitable that at some point in the future X will offer that capability. That means that it may someday provide a way for pot producers to have a way to transfer and hold money online, even if regulators haven’t passed legislation for big banks to easily do that.

Many pot stocks could benefit

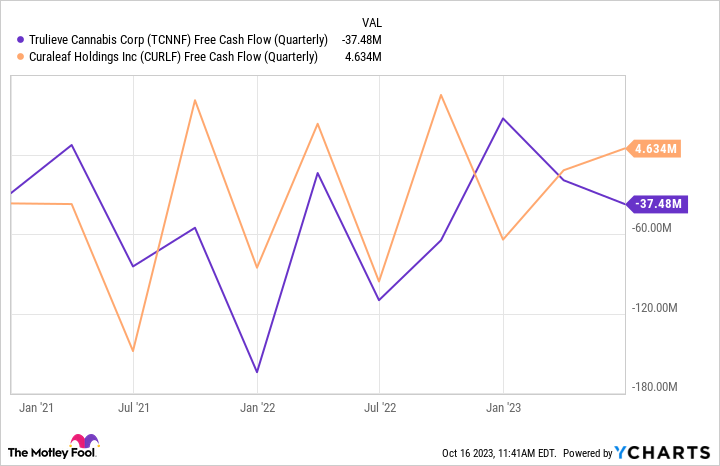

Musk allowing ads on his social media platform and possibly facilitating financial transactions could boost U.S.-based cannabis companies, including Trulieve Cannabis and Curaleaf Holdings. It would help improve their operations by potentially strengthening sales growth while also bringing their costs down (e.g., less money spent on safeguarding cash). That, in turn, may improve their free cash flow as well, which often has been negative.

Data source: YCharts

Even Canadian pot stocks such as Canopy Growth and Tilray Brands could benefit. Although they aren’t operating in the U.S. pot market, both of those companies have shown an interest in expanding south of the border. Any spotlight on the industry that could help push U.S. regulators to advance legislation should help those stocks and their valuations.

There’s hope, but investors shouldn’t jump the gun

The U.S. government hasn’t been doing the marijuana industry any favors, and it would be optimistic to assume that will change in the near future. Even under a best-case scenario, it could still be years before the U.S. legalizes marijuana. But with Musk, cannabis investors have a wildcard that may help strengthen the industry’s growth prospects even if legalization isn’t on the horizon.

This, however, may not be imminent, either. Between Tesla, SpaceX, and other projects, Musk’s time is divided and even if he’s looking to build an everything app, it won’t be overnight.

Pot stocks have taken a beating in recent years and their valuations remain incredibly low. Buying these stocks still comes with tremendous risk but if you’re comfortable with that and are willing to wait several years, there could be some potentially underrated investments to load up on in the industry right now.

H/T: www.fool.com