Cannabis short sellers are ratcheting down their bets that the beleaguered sector will continue its slide.

Short interest in pot stocks has tumbled to $632 million from $3.14 billion in May 2021, even as share prices plunged in the past year, according to data from S3 Partners. While analysts are skeptical that the federal government will approve a legal weed market soon, Congress is set to consider some cannabis legislation, which could lead to a rally in the sector.

“Cannabis short sellers were seeing the market value of their shorts decrease but were not actively replacing that short exposure,” said Ihor Dusaniwsky, managing director at S3. “Overall, the cannabis sector is not a favorite short.”

The highly volatile sector swings at the whims of lawmakers. Cannabis stocks jumped on news last week that Senate Democrats plan to introduce a bill to decriminalize marijuana, known as the Cannabis Administration and Opportunity Act.

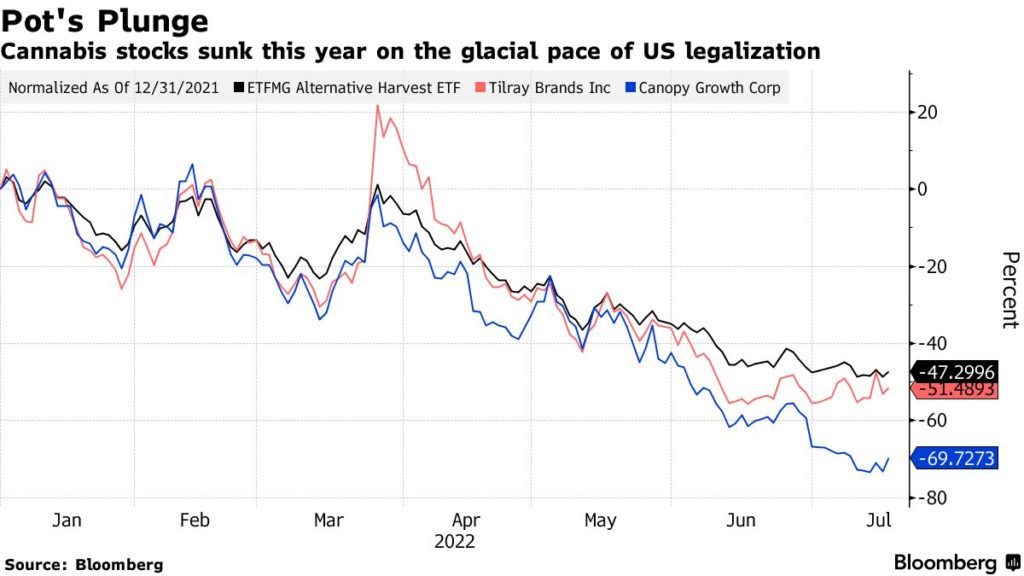

Tilray Brands Inc. posted its best day in nearly four months, and the AdvisorShares Pure US Cannabis ETF jumped the most since February. The boost continued on Monday, with Canopy Growth Corp. jumping as much as 20%, its biggest intraday jump since February 2020.

Even so, the rally barely dented the steep losses of pot stocks. The ETFMG Alternative Harvest ETF, the largest fund in the sector, spiraled 47% this year.

H/T: www.bloomberg.com

You can view the whole article at this link Short Sellers Wind Down Pot Stock Bets as Congress Mulls Action

By Stefanie Marotta on www.bloomberg.com