A new report from Massachusetts cannabis regulators described the past fiscal year – July 2023 to June 2024 – as a “pivotal chapter” for the maturation of the marijuana trade in the state, citing ever-increasing sales records, new social equity developments and upcoming social consumption business licenses.

The annual report, issued by the state Cannabis Control Commission, called out “significant milestones” in the past year for the industry, including “back-to-back record setting months of Marijuana Retail sales in June, July and August 2023” that helped the state surpass $6 billion in all-time recreational cannabis sales.

The fiscal year “also witnessed remarkable sales achievements with June establishing a new record for a single month at $132.9 million in gross sales. The ongoing trajectory continued in July and August, even with the expansion of cannabis legalization in surrounding New England states, that are also seeing record sales in recent months,” the commission reported.

The sales uptick was attributed in part to increasing sales of both marijuana plant clones and seeds, the sale of which debuted in May 2023. Although customers are limited to six clones per visit, there’s no cap on how many seeds customers can purchase.

Despite the recent news of 30 cannabis business licenses being relinquished back to the state, the report asserted that the industry continues to grow, with more permits issued each year.

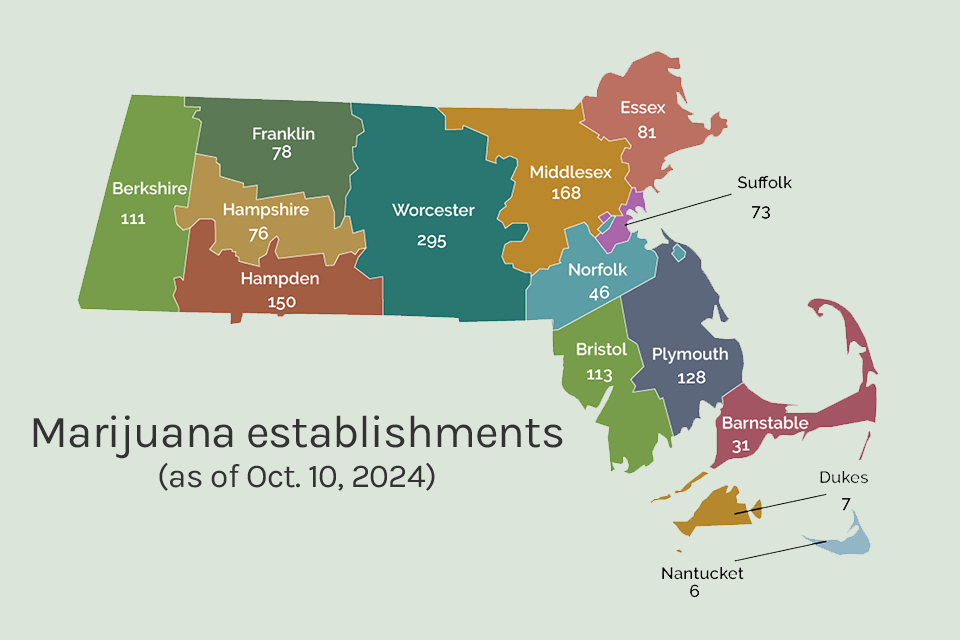

As of July this year, the commission had received a total of 1,782 license applications since the market’s inception, of which 1,290 have gained at least tentative approval, including 673 that authorized applicants to launch business operations. Of those 673, just 37 permits have been rescinded for various reasons.

The state has a total of 358 active dispensaries, the agency reported.

The CCC is also still evaluating 206 license applications and inspecting 13 provisional licenses, it reported. “Each year, the licensing team has authorized more businesses to commence operations and approved more final licenses than the previous year,” the commission wrote.

Social equity permitting is also still ongoing, the agency indicated, with delivery-related permits reserved exclusively for eligible social equity entrepreneurs. This past year, CCC staff launched a “three-year strategic planning process” to ensure the social equity program meets its goals, with its third cohort of permit applicants yet to be fully evaluated and a fourth window that ran between February and April this year.

To date, however, the state has issued just 88 finalized social equity permits, including 45 retailers, 11 delivery operators, 11 manufacturers, eight growers and a handful of other license types.

Over the past year, the CCC also revamped its oversight of “host community agreements” between cannabis companies and the municipalities in which they operate. The move was in response to years of complaints by marijuana companies that contended many towns were abusing the power to extort hefty payments from the cannabis sector.

“Since March 1, 2024, the Commission has received 304 HCAs as part of the license application and renewal process,” the agency reported.

Since October 2023, the CCC also has had the power to void HCAs if they’re found to be overly onerous.

With regard to industry oversight, the CCC also took action nine times against licensees that were found to be breaking industry rules and issued a total of $620,000 in fines, it reported.

A search for the agency’s next executive director is still ongoing, following an employee exodus that included the firing of CCC Chairwoman Shannon O’Brien and the departures of its directors of licensing and testing. (The situation got so bad that the Massachusetts Inspector General earlier this year formally asserted that the agency needs a receiver to run it.)

“Massachusetts has continued its leadership of promoting an equitable industry by expanding the Commonwealth’s status as the first state in the nation to have a municipal equity mandate,” the CCC wrote in closing, adding that its future work will prioritize “new regulations focusing on microbusinesses, delivery operators, and medical patients’ access. It will also introduce regulations for social consumption establishments, a new avenue for business growth.”

H/T: www.greenmarketreport.com