Bill under consideration would increase tax on high-potency cannabis in Washington

A new state house bill under consideration in Olympia would significantly increase the tax on marijuana products, depending on the concentrations of THC.

CONNECTING…

A new state house bill under consideration in Olympia would significantly increase the tax on marijuana products, depending on the concentrations of THC.

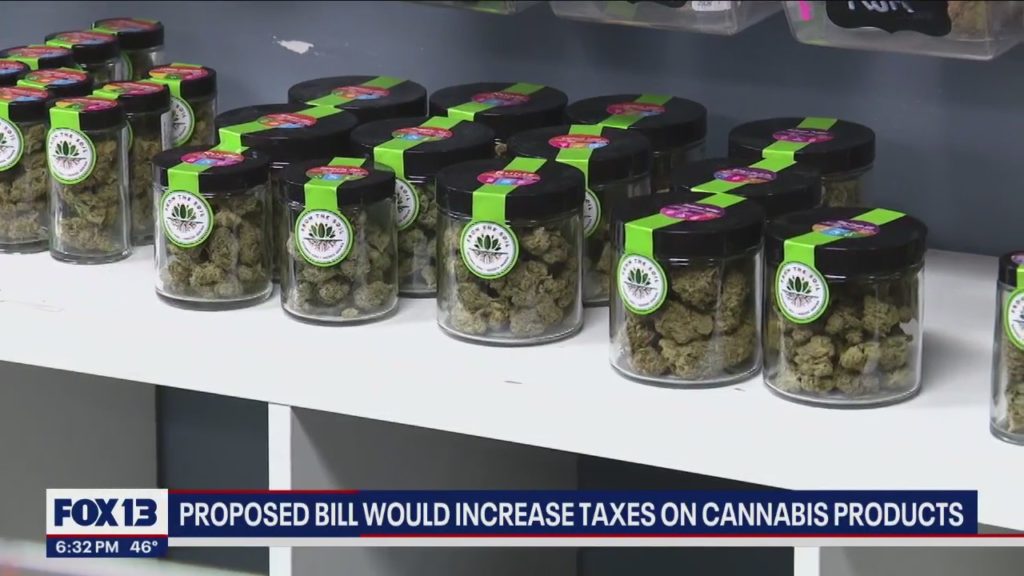

LYNNWOOD, Wash. – A new state House bill under consideration in Olympia would significantly increase the tax on marijuana products, depending on the concentrations of THC.

The creators of HB 1641 say they are attempting to address the public health challenges of high-potency cannabis. The bill’s summary states that the cannabis excise tax would be restructured into three tax rates based on product type and THC concentration.

“Kind of started thinking about, who is initiating these bills, and what’s the purpose?” said Kristian Briggs, General Manager of Euphorium cannabis store in Lynnwood. “I could say that excessive driving leaves issues with the roadways, so should we tax someone who is driving more than what we say it’s appropriate? I could go next door and get a beverage with 64 grams of sugar in it. OK, nobody has a problem with that, but if I’m a diabetic, it’s really going to impact me. So there are all of these issues.”

A 37% tax on the selling price of each retail sale of cannabis-infused products, useable cannabis with a THC concentration of less than 35%, and cannabis concentrates with a THC concentration of less than 35%

A requirement of a 50% tax on the selling price of each retail sale of cannabis concentrates and useable cannabis with a THC concentration of 35% or greater but less than 60%.

An implementation of a 65% tax on the selling price of each retail sale of cannabis concentrates and useable cannabis with a THC concentration greater than 60%.

A limit the purchase of high concentrations of THC to those under 25.

Rep. Kelly Chambers (R-25th) says one of the motivations behind introducing the tiered tax bill is to protect young people. The idea is that younger people, with less disposable income, will be deterred from purchasing high-potency cannabis at higher prices, thereby protecting still-developing brains.

“We’ve also seen that in the last 10 years since recreational cannabis has been legalized in Washington, the market has driven the demand for higher-potency products,” Chambers said. “So, that’s why they are very popular, and they are out there. At the same time, we want to maintain that public safety.”

“These are products that should not be in the hands of youth or minors and that when used improperly, they can certainly cause harm, but it gives us a lot of heartburn and worries us that such a high tax, 60-plus percent on some products, could just feed into the existing black market,” said Adan Espino, the executive director of the Craft Cannabis Coalition.

Espino says there is also concern that more taxes and other restrictions under the bill could cause more headaches for local shop owners in an already tight market.

“People are going to get what they want. Is this an avenue for them to have to go look somewhere else?” said Briggs.

H/T: www.q13fox.com