- Altria comprises over 20% of my dividend stock portfolio, and I am optimistic about its potential, even without cannabis reform.

- I believe Trump may enact federal cannabis reform due to political pragmatism and growing public support, especially among younger Republicans.

- Cannabis reform aligns with states’ rights, appealing to conservatives, moderates, and libertarians, and could ensure continued Republican political dominance.

- Economically, cannabis reform is sensible, with the U.S. industry valued at $30 billion and the potential to create 420,000 jobs and double sales by 2028.

Trump has been pivoting towards a pro-cannabis stance heavily since his election campaign and Altria (NYSE:MO) stands to benefit from this development substantially. In August last year, Trump stated that tax dollars shouldn’t be wasted on arresting individuals carrying personal amounts. He also specifically expressed openness to “focus on research to unlock the medical uses of marijuana as a Schedule 3 drug,” and finally pardoned Ross Ulbricht in January, who operated a dark web marketplace known for drug sales. These points and more outlined in this article will make the case that I don’t just believe that just a reclassification is plausible, but likely during his presidential term.

The Political Case

MO comprises over 20% of my total dividend stock portfolio, and I would happily, hold, and keep buying MO even if my cannabis thesis for MO does not play out. However, I think that there’s a good chance that Trump will enact some form of federal cannabis reform during his term as president.

Trump continues to show a kind of expediency or pragmatism over sticking to purely conservative values. Therefore, politically, I think that there are some key signs that the groundswell of support for cannabis reform (which would be massively beneficial for Altria) is beginning to take shape.

Firstly, the majority of Americans (between 68-70%) support full legalization, and this also extends to the majority of Republicans under 50 years old. Voters in swing states like Arizona, Florida, and most importantly, Pennsylvania are asking for cannabis reform in increasing numbers.

| State | Percentage of Voters Supporting Legalization |

| Arizona | 69% |

| Florida | 66% (Amendment 3), but only 56% voted “Yes” in the election |

| Pennsylvania | 68% |

Although it’s extremely early in Trump’s terms, and he cannot run a second time, I see it reasonable that Republicans would shift on this issue to ensure continued Republican dominance politically. Trump could even frame it as being a states’ rights issue, which would still be in alignment with conservative values while also appealing to moderates and libertarians. Further support for this potential avenue is in the form of a survey outlining that 70% of likely Republican voters support states’ rights to lead on cannabis legalization, and Senator Rand Paul echoed these exact sentiments.

So the political willpower is already present in both the general and Republican voter base. But what makes this more interesting is that I also think that the administration is actively exploring further political, as well as economic, justification to reform cannabis.

Specifically, the Trump administration invited conservative cannabis lobbyists this month. This included Howard Woodridge of Citizens Against Prohibition, where he submitted his proposal on ending the war on drugs and treating it as a medical issue. Trump himself in the past has sometimes expressed (albeit contradictory) stances on marijuana, but has shown support for states to endorse their own cannabis laws. What this all means to me politically is that not only is rescheduling or reform plausible, it serves a pragmatic strategic focus. In other words, it’s a small part of the puzzle for why I think it seems more likely than not we’ll see increased momentum in favor of cannabis in the coming months.

The Economic Case

In addition to being politically opportunistic, I also think that financially it also makes total sense for cannabis reform. The cannabis industry in the U.S. is also already valued at $30 billion, and could create an additional 420,000 jobs. In sum, the industry is expected to generate between $45 and $50 billion in sales by 2028.

However, the economic environment is not so straightforward. In order for companies like Altria to unlock the full value from the cannabis market, the classification of cannabis would need to change from a classified Schedule I controlled substance. The previous Biden administration made serious inroads to classifying cannabis to Schedule III, in light of its economic and political benefits and overall lover abuse potential. Broadly classifying cannabis as a Schedule III controlled substance would alleviate the 280E tax burden on cannabis businesses, which precludes them from deducting typical business expenses due to cannabis being classified as a Schedule I controlled substance.

If the 280E tax burden is erased, then this would make the cannabis industry significantly more profitable and viable. Specifically, it’s estimated that it could enhance the net margins for cannabis companies by around 20% to 30%, thereby removing unfair tax burdens and unlocking profitable earnings steams for companies like Altria.

Therefore, in sum, it makes sense politically and there’s clear economic logic for additional job creation and tax revenue. I think this is the kind of “deal” that Trump would be interested in bargaining and closing.

Altria’s Cannabis Position

Altria has had its foot in the door in the cannabis market for a long time, and its potential synergies with its tobacco and smokeless product segments are enormous. The company presently has a 41% ownership stake in Cronos group, which is valued at roughly $500 million at the time of writing. This gives it exposure to crucial R&D and global distribution channels, along with a crucial U.S. market entry point.

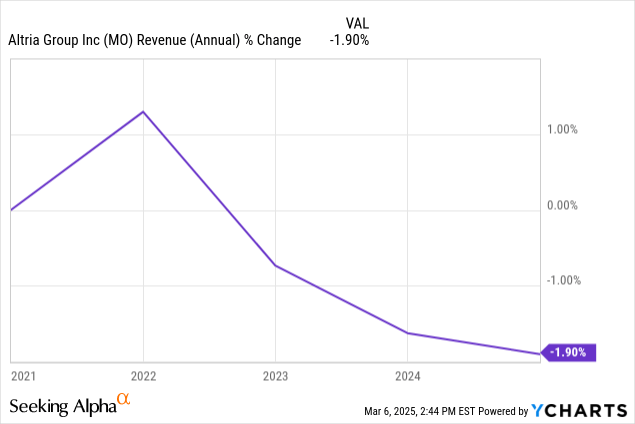

The main advantage is that it could help redefine Altria as not just seen as a tobacco known for its Marlboro cigarettes. Although the firm’s free cash flow and earnings are highly robust, Altria’s top-line erosion is something that concerns many analysts, including myself. The explosion of popularity for vaping seen in the younger generation has clearly cut into its revenue growth, and while its position is very solid, the company can no longer be said to be growing from a revenue point of view.

However, I do think that it’s plausible that cannabis will be broadly reclassified into a Schedule III substance, and I don’t think there’s any better company than Altria in the U.S. that is equipped to take advantage of such ha shift. It has decades of experience navigating tobacco regulations, age verification and distribution rules. It has relationships with over 200,000 convenience stores and retail outlets that would allow it to quickly scale its cannabis and cannabis-adjacent products like low-dose THC vapor pods or cannabis-infused oral pouches.

If Altria could capture just a few percentage points of the cannabis market in the U.S. that would translate to at least a few billions in top-line to stop the erosion, and with its present margins and ongoing margins raise its EPS substantially too. It’s exactly the kind of catalyst that Altria executives are hoping for.

In sum, I think that cannabis reclassification in the U.S. is realistic because:

- The current Trump administration is far more libertarian-leaning economically than previous recent administrations, with a focus on paying down the national debt, cutting or reducing foreign aid entirely, establishing a cryptocurrency reserve fund and pursuing domestic growth over global entanglements. Legal cannabis sales would be a logically consistent next step.

- The majority of voters in key swing states are in favor of it, and Trump can frame the decision as a states rights’ issue, which is also consistent with more traditional conservative ideologies of federalism. This leads me to believe it may take to come to a head near the end of his presidency.

If any of these pieces were missing, I would not be confident, but it has all the pieces in place to be what, I think, will be a slow grind towards reclassification that would end up being a huge boon to Altria’s valuation. In the meantime, I’m more than happy collecting my 7%~ NASDAQ-like dividend yield while I wait (with some trepidation) for this thesis to play out. I believe that the economic logic and political willpower will win eventually over the disagreements in the Republican bloc that strongly oppose it.

Valuation

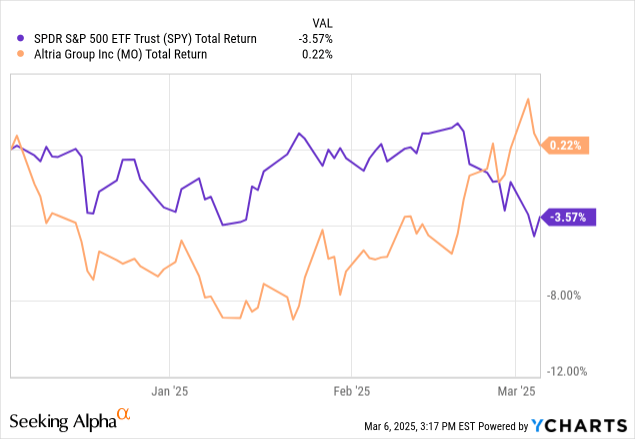

Altria has shown some resilience strong over the past month while the broader market has pulled back. I interpret this as a positive sign moving forward for Altria, as investors pivot away from the sky-high expectations of stocks such as NVIDIA and into companies whose visibilities are more reasonably clear.

My cannabis thesis is speculative, although it is backed by evidence and consistent reasoning. In saying that, I still believe that Altria is a good buy at these levels, as I anticipate that tech stocks will continue to show weakness. Defensive and durable companies consistently shine during times of uncertainty, and I think much of the wobbles in the broader market can be chalked up mostly due to the ongoing tariffs and impatience of AI delivering on its promises.

I then think that when adjusting for risk, buying Altria with its durable (and rising) stock price in this environment makes a lot of sense for those who have more of a dim view of the euphoric market. Any stock price accumulation, of course, is a nice bonus, but the huge compounding yield in a defensive stock is a key reason it’s my most-held dividend stock.

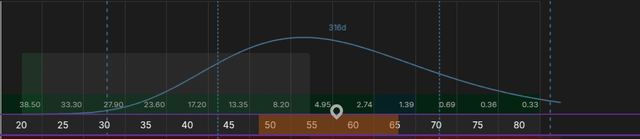

To add further conviction to my buy thesis, the long-term options market for Altria also shows that its current stock price at $57 is right in the median price range for calls at are in the money. The shape of the curve also shows right-skewed kurtosis (leptokurtic with a right tail bias). In plain English, this means that the market is pricing is in more potential positive price appreciation beyond the current median price. While most calls bought are at the median, there’s a moderate bullish bias due to the longer and fatter right tail. The stock then is fairly valued in this respect, but probabilistically, the options market believes it’s more likely than not that there will be a higher stock price than $57 ending January 2026. This is something that that traders are both hedging against or speculating on.

Risks

Trump has shown far more unpredictability than in previous administrations. I don’t think most people saw the Greenland or the repetition of Canada’s ambitions coming, and the situation remains volatile. This makes it harder to predict if the cannabis reforms will come during his term, although it makes both economic and political sense. F

Furthermore, although Republican support for cannabis support is strong, resistance within the establishment remains formidable. Socially conservative lawmakers such as Mitch McConnell remain firmly opposed to the idea.

Finally, if Trump opts for a state’s rights approach (as he did with the abortion issue), instead of widespread federal legalization, it may benefit certain markets, but not deliver the needed visibility for Altria to capitalize on it fully. The 280E tax burden is a serious thorn in the side for integration into existing corporate structures like Altria and may be infeasible without it.

Conclusion

I’m aware that this thesis is early and speculative, but I do think that there’s more than a 50% chance that Trump will make serious or definitive inroads into reclassifying cannabis for the additional tax revenues and to further bolster the supreme economy of the U.S. Even if it does not come to fruition during his time, it’s an idea that has been building momentum quickly, and I would bet money on a reclassification happening within the next decade and massively benefitting Altria.

H/T: seekingalpha.com