280E? Is that a Mercedes-Benz? No. Well yes it is, but that’s not what we’re talking about here.

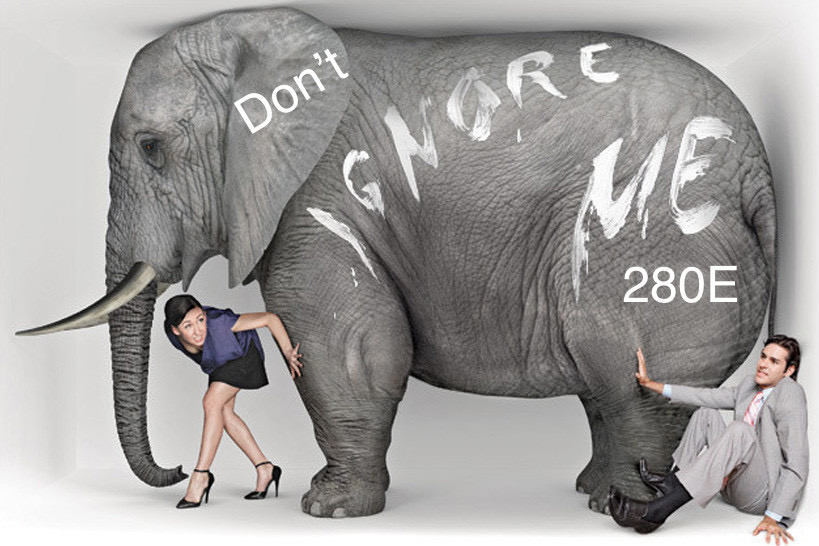

Most people would say something like “You’re in the medical/recreational marijuana business? You must be loaded!” Major misconception. Especially when considering that 280E stands in the way of dispensary/production business models. This is something that needs to be talked about. Especially with CT taking in rec applications. New players coming to the table need to be aware of these tax laws, or it could cost you your business.

If you go to (https://www.law.cornell.edu/uscode/text/26/280E) you can see the law in its entirety, but let me tell you what it is in a nutshell.

During the 80s obscene amounts of cocaine were being smuggled into the U.S. which these groups had started import and distribution companies and were actually writing off staff and equipment on their TAXES. So, the federal government implemented 280E, which made it illegal for these groups to write off normal business expenses because the business in itself was illegal.

280E is applied to medical/recreational cannabis dispensaries/producers, so they too cannot write off their normal costs of doing business; even being a legal business under their state laws/guidelines they are still illegal in the federal eye. So, what does this mean?

For starters the federal government takes about 50% of a dispensary’s profits (and I’m being generous to the dispensaries) right out of the gate in taxes.

Then there is the expense of staff (God help you if you’re a state that needs a Pharmacist. Do you have any idea what they cost?), security (both guards and/or equipment are expensive), utilities, internet, computers, software systems (point of sale and office related systems), banking, credit/debit systems (good luck with these too, banking is a separate issue) insurance, rent, maintenance, facility upkeep/upgrades, supplies (office/retail), advertising, website, social media, legal services, licenses, permits, zoning, delivery/shipping, packaging, charity donations, staff moral team building, and of course the products you’re selling to your patients/customers.

But in this case we can write off the costs of goods, but that’s it and nothing else. Not much is left after that when you think about it in the form of a business.

Have a good business plan and get an attorney along an accountant. Make sure that they know each other.