FOOL

Investors in these companies should be careful what they wish for.

Marijuana legalization in the U.S. has been a hot topic of late as there’s growing excitement about the possibility that significant reform will take place in the industry. A couple of companies that are eager to enter the U.S. pot market include Canopy Growth (CGC -1.70%) and Tilray Brands (TLRY -2.86%).

Having access to the world’s largest pot market would be a huge opportunity for these businesses. But investors should be careful of assuming that it will make them both good buys or that their stock gains afterward will wipe out the losses investors have incurred on these troubled stocks thus far. Here’s why legalization could actually be a bad thing for these two stocks.

They’ll be facing plenty of competition out of the gate

Unlike when Canada legalized recreational marijuana in 2018, there are already marijuana companies in the U.S. that are in the recreational market. It won’t just be a massive rush to grab land and market share; Canadian-based pot producers will have to fight for it with established companies. The quasi-legal environment where pot is federally illegal but legal in many states has allowed the industry to grow in the U.S. despite being off-limits to Canadian producers like Canopy Growth and Tilray Brands.

And the competition those companies would face upon entering it would be fierce. Many multi-state operators (MSOs), including Trulieve Cannabis, Curaleaf Holdings, and Green Thumb Industries are all generating $1 billion or more in revenue on an annual basis. You would have to combine the top lines of Tilray Brands and Canopy Growth for them to come close to that mark.

Obviously, both companies would grow upon entering the U.S., but the point is, it wouldn’t be easy to grab market share. The Canadian companies would also likely need to spend significant money on their expansion efforts south of the border, which could deepen their losses and lead to higher rates of cash burn.

Investors will have more options, and that could adjust valuations

One of the most underrated impacts legalization will have is that MSOs will be able to list on a major exchange like the Nasdaq or New York Stock Exchange. Since they are plant-touching businesses, they are in violation of federal laws and need to remain on an over-the-counter exchange. That means they have access to a smaller pool of investors, which results in less of a premium that’s paid for these stocks.

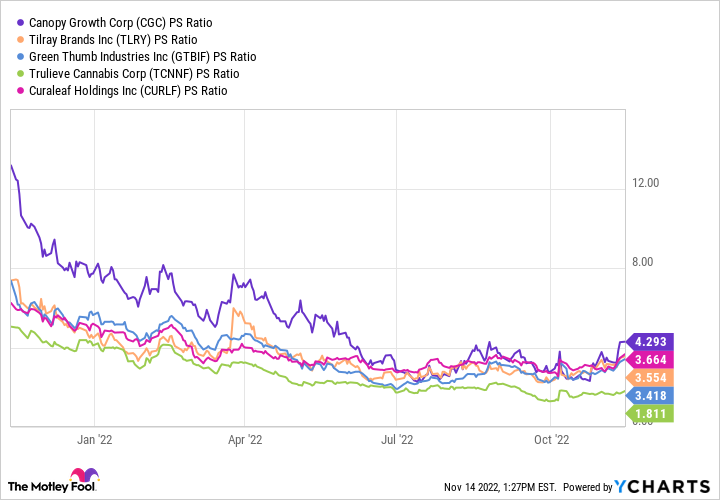

CGC PS Ratio Chart

Valuations have come down for pot stocks in the past year, but Canopy Growth, and to a lesser extent Tilray Brands, have normally traded at higher premiums than MSOs. That could significantly change in a more level playing field where investors have the same access to all pot stocks.

Canopy Growth and Tilray Brands could end up being worse buys

The big advantage Canopy Growth and Tilray Brands enjoy right now is that they trade on a major exchange. When that’s gone, they could find it hard to attract investors. While Canopy Growth has partnered with Acreage Holdings and Tilray Brands will probably convert its notes in MedMen Enterprises into stock, those are businesses that generate less than $200 million in annual revenue, and they also burn through millions in cash. While Canopy Growth and Tilray Brands may expand their top lines by consolidating those businesses, their losses could also get deeper in the process.

If the U.S. legalizes marijuana, the hype surrounding it would undoubtedly send shares of Canopy Growth and Tilray Brands higher in the short term. But in the long run, both businesses may end up struggling, and I’m not convinced they will end up being better investments. Investors are better off investing in cannabis businesses that are doing well today, not ones that might do better after legalization, which could be years away from happening, if at all.

Here’s The Marijuana Stock You’ve Been Waiting For

A little-known Canadian company just unlocked what some experts think could be the key to profiting off the coming marijuana boom.

And make no mistake – it is coming.

Cannabis legalization is sweeping over North America – 18 states plus Washington, D.C., have all legalized recreational marijuana over the last few years, and full legalization came to Canada in October 2018.

And one under-the-radar Canadian company is poised to explode from this coming marijuana revolution.

Because a game-changing deal just went down between the Ontario government and this powerhouse company…and you need to hear this story today if you have even considered investing in pot stocks.

Simply click here to get the full story now.

This Stock Could Be Like Buying Amazon in 1997

Imagine if you had bought Amazon in 1997… a $5,000 investment then would be worth more than $4 million today.

You can’t go back and buy Amazon 20 years ago… but we’ve uncovered what our analysts think could be the next-best thing: A special stock with mind-boggling growth potential.

With hundreds of thousands of business customers already signed up, this stock has been described as “strikingly similar to an early Amazon.com.”

H/T: www.fool.com