Canopy Growth has burned investors, and a rebound isn’t a sure thing.

Cannabis company Canopy Growth (CGC -1.40%) has been a wild ride for investors over the past several years, soaring to more than $45, followed by sharp declines.

The legalization of cannabis in Canada and parts of the United States created excitement for a growing but immature industry.

Canopy Growth has fallen to its deepest depths; shares have fallen nearly 90% over the past year to $3. However, don’t assume there’s light at the end of the tunnel; here’s why shares could struggle to get up from here.

Several things going wrong at once

A report from Grand View Research estimates that the cannabis market in North America was worth $12.4 billion in 2021 and could grow 15% annually until 2030. Canopy Growth has self-proclaimed aspirations to be the premium cannabis brand in North America.

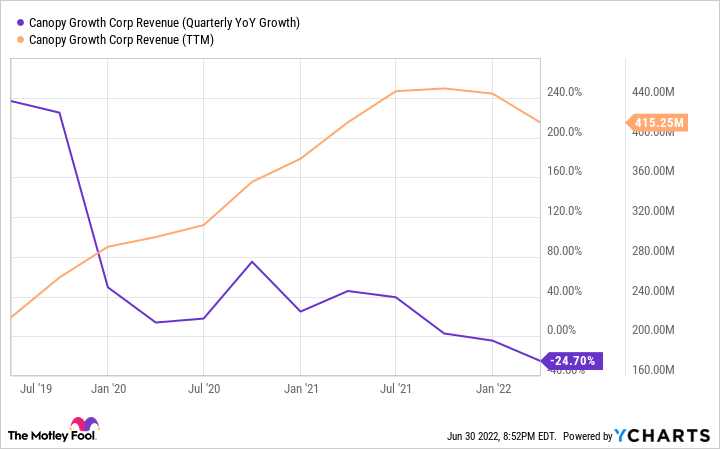

But the company is hitting some roadblocks to its goal; revenue growth has faded, including a 25% year-over-year decline in revenue in the fourth quarter of fiscal 2022 and a 5% decline for the full year ending March 31, 2022.

Management stated that a decline in its organic Canadian business offset growth from acquisitions and growth in other product categories. Losing sales in a growing market seems like competition more than anything.

You can view the whole article at this link This Former Market Darling Is More Weed Than Flower