In recent years, the cannabis industry has faced its fair share of controversies, one of the most notable being the infamous “VapeGate” scandal. Occurring in 2019, this incident revealed unsafe levels of harmful substances in various marijuana vaping products, leading to widespread panic and concern about the quality of products in the cannabis market.

However, the core issue was not necessarily rooted in the regulated cannabis marketplace, but rather, it stemmed from an inundation of counterfeit and illicit products—many of which were allegedly sourced from China. As mainstream media continues to highlight these concerns, it becomes increasingly crucial to understand the implications of these fake products and/or supply chain on an industry striving for legitimacy and safety.

The Impact of VapeGate

“VapeGate” sent shockwaves through the marijuana sector, primarily because it spotlighted the shortcomings of certain unregulated products that had allegedly infiltrated the state-regulated marijuana markets. Reports detailed that many unsafe vape cartridges contained harmful levels of heavy metals and other contaminants due to the use of subpar materials and manufacturing processes often associated with Chinese production. However, these products were not representative of the state-regulated marijuana markets, which (as a general rule) has safety and quality standards in place.

Despite this distinction, the media coverage often blurred the lines between illicit and legal (i.e., regulated) products, enforcing misconceptions about the broader marijuana sector. The authentic marijuana products were overshadowed by the dangerous, counterfeit alternatives that mimicked legitimate offerings. This confusion served to fuel public skepticism regarding lawful marijuana, putting legitimate producers on the defensive and driving a wedge between them and potential consumers.

Perpetuating Misinformation Once Again – This Time with Regulated Hemp Derivatives

Fast forward to today, and the same (Chinese source) narrative is appearing in discussions surrounding regulated hemp derivatives, notably Delta-8 THC (D8). By way of background, President Trump signed the Farm Bill in December, 2018, which created the federally-legal $23B hemp derivative industry. As states navigate this burgeoning market for hemp-derived products, recent media articles have raised alarms about safety and regulation. Much like during the VapeGate crisis, these reports tend to equate the packaging and labeling of legitimate, state-regulated hemp products with those produced in illicit markets or sourced from overseas, specifically China. This failure to adequately differentiate lawful producers from counterfeiters contributes to ongoing misinformation in the industry.

Reports focusing on the dangers of hemp-derived products often neglect to mention that many of the concerning items come from unregulated sources that prioritize profit over safety, and which are not registered with the relevant hemp-derivative oversight agencies at the state-level. While approximately seventeen states have enacted regulations rewarding quality production standards, many discussions still originate from perspectives that blanket all hemp derivatives as unsafe—leading to a collectively negative perception of the entire industry.

Passport: Explore the finest destinations and experiences around the world in the Forbes Passport newsletter.

By signing up, you agree to receive this newsletter, other updates about Forbes and its affiliates’ offerings, our Terms of Service (including resolving disputes on an individual basis via arbitration), and you acknowledge our Privacy Statement. Forbes is protected by reCAPTCHA, and the Google Privacy Policy and Terms of Service apply.

Relevant Regulations and U.S. Supply Exist

But to investigate the bases of these allegations is imperative. And so, I will do my best here to summarize what I found.

First, regarding supply (i.e., the China issue), there are several companies that control the majority of the state-regulated hemp derivative marketplace — 3Chi, LaurelCrest, FM Labs, MC Nutraceuticals, Open Book Extracts, Biopyure, Arvida Labs, to name a few. I reached out to these companies for background and have worked with numerous companies that do business with them over the years. I learned that these groups work very diligently each week to source various hemp extracts from U.S-grown hemp? This is not to say that there are not bad actors out there (as in all industries, including the marijuana sector) acquiring hemp material or products from China, but this would not be reflective of the state-regulated hemp derivative supply chain and marketplace, just like VapeGate was not necessarily indicative of the regulated marijuana marketplace.

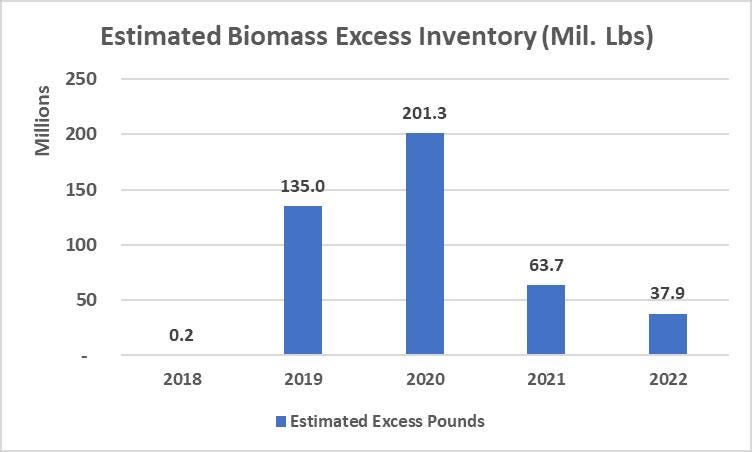

But didn’t U.S. hemp production decline dramatically in recent years? And so, where are we getting all of these hemp derivatives? Well, beginning in 2019, U.S. farmers produced well-over 400,000 million pounds of hemp biomass excess inventory, for a wide variety of reasons that I do not have time to detail here. In short, there was a tremendous oversupply of hemp biomass beginning in 2019, which led to the production of CBD isolate (U.S.-produced), and which continues to supply the U.S.-based hemp derivative market to this very day. Whitney Economics prepared a graphic illustrating the same:

*Data/Chart from Whitney Economics

Whitney Economics

Whitney Economics further discovered that almost 50% of those U.S farmers had residual inventory year over year beginning 2019. This is coupled with the data point that, through 2020, nearly 60% of the processing/product manufacturing capacity was not being used. It has only begun being used at majority capacity in the past few years. “So regardless of the amount of excess supply, the processors were not pulling it though the supply chain,” says Beau Whitney.

In short, says Whitney, “the claims about China supply is mistaken. The data does not show this at all.”

Regarding the safety of regulated hemp derivatives, it is important to note that the industry leaders perform testing through the supply chain nearly 5-6 more times than the regulated marijuana sector. My Forbes colleague, Will Yakowitz, does a great job detailing the operation of 3Chi and the rigorous standards applied.

In addition, the state-regulated hemp derivative ingredient supply chain generally requires all operators to be GMP compliant, which means that a company is following standardized Good Manufacturing Practices (GMP) principles and procedures to ensure that their products are consistently produced and meet quality standards. Joel Searls, Director of Compliance at leading cannabinoid supplier, MC Nutraceuticals, is proud of his company’s GMP-certified facilities (see pics below), and states: “at MC Nutraceuticals, we seek to provide the safest consumer-friendly ingredients. As such, we have followed the tenets of GMP compliance for quite some time, and under the State of Colorado’s hemp program, we achieved third-party validated GMP compliance. We are very proud of this.” He goes on to add that “as an ingredient supplier that services hundreds of businesses across the U.S., we have worked across the regulated hemp derivative sector and just about every operator I see is either GMP-compliant, or is in the process of achieving the same.”

MC Nutraceuticals

As such, it is important to note that hemp derivatives are indeed state-regulated and can be produced safely, much like marijuana sector products, but at a higher standard because of the food health and safety regulations applied thereto. CEO, Mike Dee, of Flora Bio Group indicates that “FM Labs, as a leader in the hemp ingredient manufacturing industry, is committed to supporting American farmers within our supply chain while ensuring the highest levels of quality, purity, and safety. Our rigorous testing protocols guarantee that our products meet strict cGMP and compliance standards, which is an integral part of our safety commitment not only to the consumer of our products but also to our manufacturing employees. This reflects the broader hemp industry’s dedication to responsible and sustainable production practices.”

Colorado’s regulated hemp sector is a national leader. After a year-long task force and a formal/informal legislative stakeholder process, very specific legislation and corresponding regulations were drafted and put into place. The Colorado Department of Public Health and Environment’s (CDPHE) scientific and enforcement teams, closely examined this issue and provided extremely detailed rules and standards for producing such products and compounds. In doing so, the CDPHE worked openly and very closely with industry operators, concerned citizen groups, and even the marijuana sector, to develop these rules. These detailed standards provide production requirements, safety standards, and storage and labeling requirements. There are detailed lists of approved solvents, residual solvent levels, and the like. Suffice to say, this was not a high school science project.

Because Colorado’s hemp derivative manufacturing complex is one of the largest in the country for export (outside of Colorado), these officials took on this role very seriously and put their scientists to work. The result is groundbreaking regulation that proves that there is a safe way to produce these derivatives — even converted compounds. Point is: there is a scientifically-sound policy roadmap for hemp regulation and the manufacture of these products, and numerous other states have followed suit and have actively regulated these sort of hemp products.

The Need for Uniform Regulation and Clarity

The challenge presented by Chinese fake hemp products and supply compounds and the associated misinformation cannot be understated. Consumers rely on media reports to inform their choices, yet the failure to clearly differentiate between legal, state-regulated products and counterfeit alternatives and/or misinformation leads to confusion and mistrust. Articles critiquing the hemp industry must strive for transparency and hang their credibility on established facts about regulation and safety standards.

The reality is that legitimate regulated hemp derivative producers are held to rigorous safety guidelines, including checks on residual solvents, safety assessments, and clear labeling standards. Unlike the false Chinese supply narrative and the fake products creeping in from the illicit market, these operators are monitored and regulated by state agencies to protect consumer health.

In the paint of negativity and skepticism directed toward the marijuana and hemp sectors, it’s crucial for stakeholders, including media outlets, to draw clear boundaries between regulated and unregulated products. The impact of associating legitimate hemp derivatives with dangerous, counterfeit products or allegations of supply chain safety only serves to undermine the hard work of compliant businesses striving to establish their credibility and provide safe products to consumers.

Conclusion

As the regulated hemp derivative markets continue to evolve, the import of transparency, regulation, and public education becomes increasingly vital. Chinese fake hemp products and the misinformation generated by the media can threaten the integrity of a burgeoning industry that has the potential for significant economic and health impacts. Understanding the distinctions between regulated products and their counterfeit counterparts is essential not only for consumer safety but also for restoring confidence in an industry working toward legitimacy and public benefit. It is the responsibility of every stakeholder, from producers to consumers to the media, to promote clarity and understanding in the face of confusion.

H/T: www.forbes.com